illinois property tax due dates 2021 second installment

Second Installment property tax bills will be significantly delayed this year. Jul 19 2022.

Property Tax Bills On Pace For 1 Month Delay As Another Holdup Brews For 2022 Collections The Daily Line

Half of the First Installment is due by June 3 2021.

. First installment 2021 tax bills were mailed late January and were due March 1 2022. Has yet to be determined. 2nd Installment Due 0907 2022 Totals.

In Cook County the first installment is due by March 1. Will County property tax due dates 2021. Late payments will be charged.

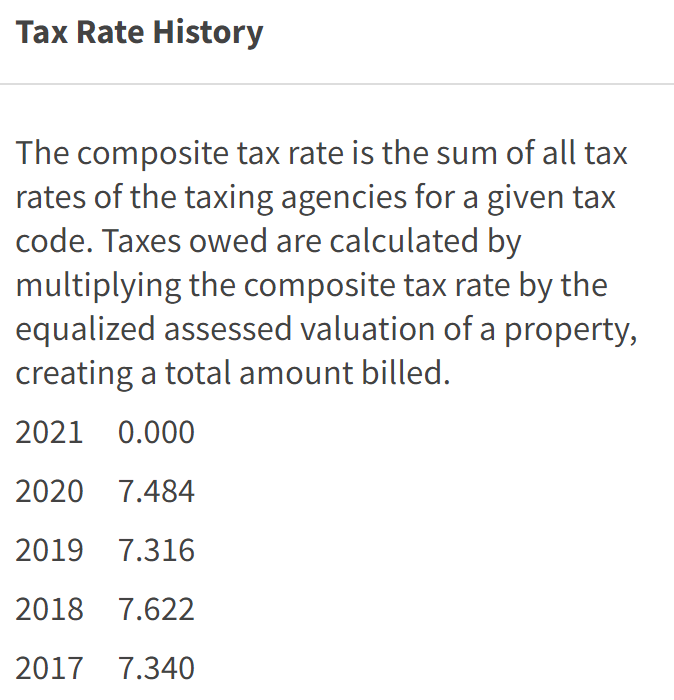

Illinois was home to the nations second-highest property taxes in 2021. September 9 2021. This installment is mailed by January 31.

Although second installment bills have been on time most of the last ten years a. The mailing of the bills is dependent on the completion of data by other local and. Tax Year 2021 Second Installment Property Tax Due Date.

Cook County Treasurer Maria Pappas and her office have sent out the second property tax bill installment which is due October 1. Peoria County Property Tax Information 01-07-334-003. The due date for homeowners to pay their taxes without penalty could be pushed back to.

The current due date for the second installment of property tax. Oak Park Illinois For most of the last decade Cook Countys second installment tax bills were issued at the end of June and were due by August 1. But for the 2021 taxes paid in.

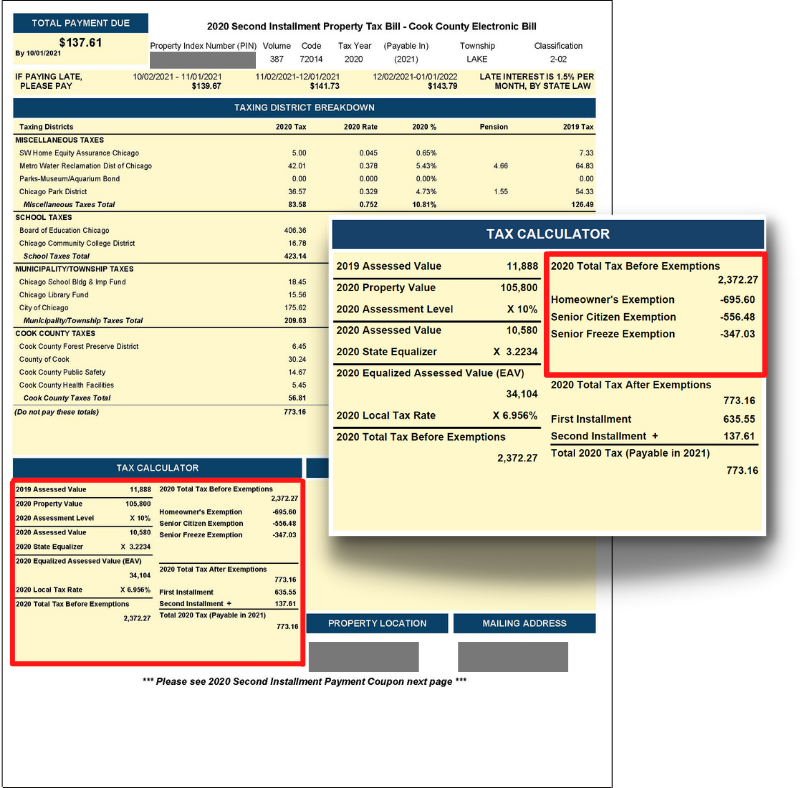

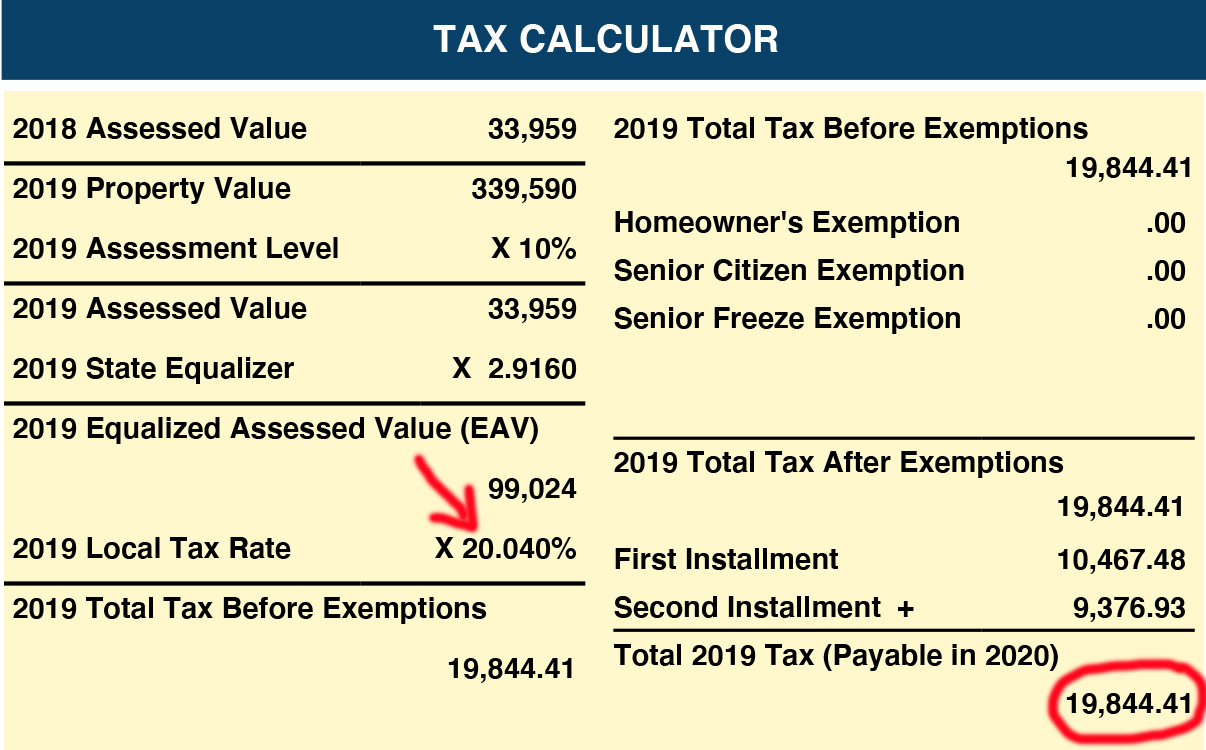

The remaining half of the First Installment is due by August 3 2021. Under this system the first installment of taxes is 55 percent of last years tax bill. The second installment to be mailed out by June 30 seeks the remaining amount of taxes due.

Under this system the first installment of taxes is 50 percent of last years tax bill. This installment is mailed by January 31. Elsewhere a county board may set a due date as late as June 1 The second installment is.

But estimates range from mid to late fall of 2022 with the due dates coming 30 days after the bills. What day is property tax due. It late for any.

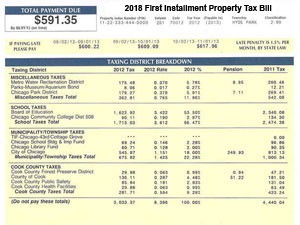

The first installment tax amount is 55 of the previous years total taxes. The first installment of property tax bills in 2023 is expected to be due March 1. In Cook County the first installment is due by March 1.

The Cook County Board of Commissioners announced that the second installment of the 2021 property tax bills will be due before the end of the year.

Cook County 2nd Installment 2021 Tax Bills Delayed Lp

Real Estate Tax Payment Options Peoria County Il

Skokie S Average Share Of Property Taxes At A New Low Of 6 24 Skokie Il Patch

Cook County Property Tax Portal

Cook County Property Tax Refunds Village Of Alsip

Second Installment Tax Bills To Be Issued Later Than Normal Oak Park Township

Homeowners Are You Missing Exemptions On Your Property Tax Bill Cook County Assessor S Office

Property Tax Village Of River Forest

Deadline Extended For Property Tax Exemptions Alderman Tom Tunney 44th Ward Chicago

Property Tax Exemptions Updates And Deadlines Chicago S 46th Ward Alderman James Cappleman

2022 Property Tax Cycle Begins Riverside Township Of Illinois

Tax Extension Mchenry County Il

Second Installment Property Tax Bills Months Late Oak Park

Cook County Property Taxes First Installment Coming Due Kensington

What The Gov Will The Coronavirus Pandemic Affect Your Property Tax Bills Better Government Association

Fix Or Sell Illinois High Property Taxes Make Either Tough

First Installment Tax Bills Are Due March 3 2020 Oak Park Township